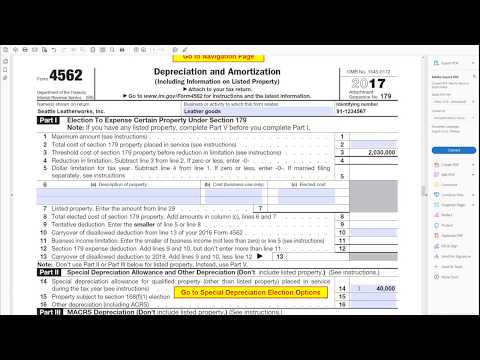

Hi, this is John with PDFtax.com. We have on the screen here Form 1120, the U.S. Corporation Income Tax Return. This is the official government form that we're looking at. It was downloaded from IRS.gov and has been enhanced in a couple of ways. The most obvious enhancement is the yellow navigation buttons that you see. These buttons are visible on the screen, but if you were to print the paper copy, they would not appear. You can use this form to file your return with the IRS since it is the official government form. In addition, we have added some calculations here. For example, if you enter 350 in a specific field, that value is automatically carried down to line 11 for you. This makes the process easier. Now, let's work with this form a little bit to see how it functions. I have created a fictitious company called Seattle Leather Works. They specialize in making leather products such as handbags. We have already entered the sales information. Next, let's move on to the cost of goods sold. To do that, we will click right here, which will take us to another form. The beginning inventory for the company is $4,500, and the purchases made during the year for raw leather are $62,000. The cost of labor, which includes salaries paid to the employees who make the handbags, is $120,000. The ending inventory is $6,000. Next, we have a couple of questions to answer. The inventory method used is cost, which is the most common one. The other two options do not apply in this case, so we will skip over them. Similarly, we will select "no" for the two following questions since they are not applicable to this company. Now, let's continue with this tax return. We will go...

Award-winning PDF software

1120-L Form: What You Should Know

Form 1120-L, U.S. life insurance company income tax return template Filler: Form 6166 — Supplemental Income This form is one of many options available from the IRS for income tax filers who have received Supplemental Income. The form enables you to claim the earned income of dependents other than your spouse. When you complete and submit Form 6166 for income tax purposes, the taxpayer is no longer required to report the amount of Supplemental Income Form 706 — Income, Gift, and Generation-Skipping Transfer Tax (GST) The Form 706, Information Return on Benefits and Payments Due for Generation-Skipping Transfers, is used to report taxes in connection with a transfer of property Form 706, Information Return on Benefits and Payments Due for Generation-Skipping Transfers In general, the return provides information on the transfer of property to children younger than age 18. Form 7008 — U.S. Life and Health Insurance Tax Return with Additional Information This informational return includes information on the terms and conditions for life and health insurance policies. It also provides information about your right to cancel an insurance policy if your coverage ends, and your rights to claim a refund if you are denied coverage. Form 706 — Information return for policy transfers This informational return includes information on the terms and conditions for life or health insurance policies provided to you by a U.S. employer. It also includes information about your right to cancel an insurance policy if your coverage ends, and your rights to claim a refund if you are denied coverage. Form 706B — Generation-Skipping Transfer Return The Form 706B, Information Return on Benefits and Payments Due for Generation-Skipping Transfers, is used to report taxes for transfer of property to your children after you die and before you actually transfer that property to them. It generally applies to your transfer of property during your lifetime. Filler: Form 1040A, U.S. Individual Income Tax Return This informational return provides tax information to individuals. For this form, all amounts reported are reported, even amounts not reported on a Form 1040. This form is used for certain types of tax returns, such as Forms 1040L and 1040EZ, and you would need it for the tax filing deadlines in the calendar year at issue. Form 1040, U.S.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1120-L, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1120-L online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1120-L by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1120-L from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1120-L